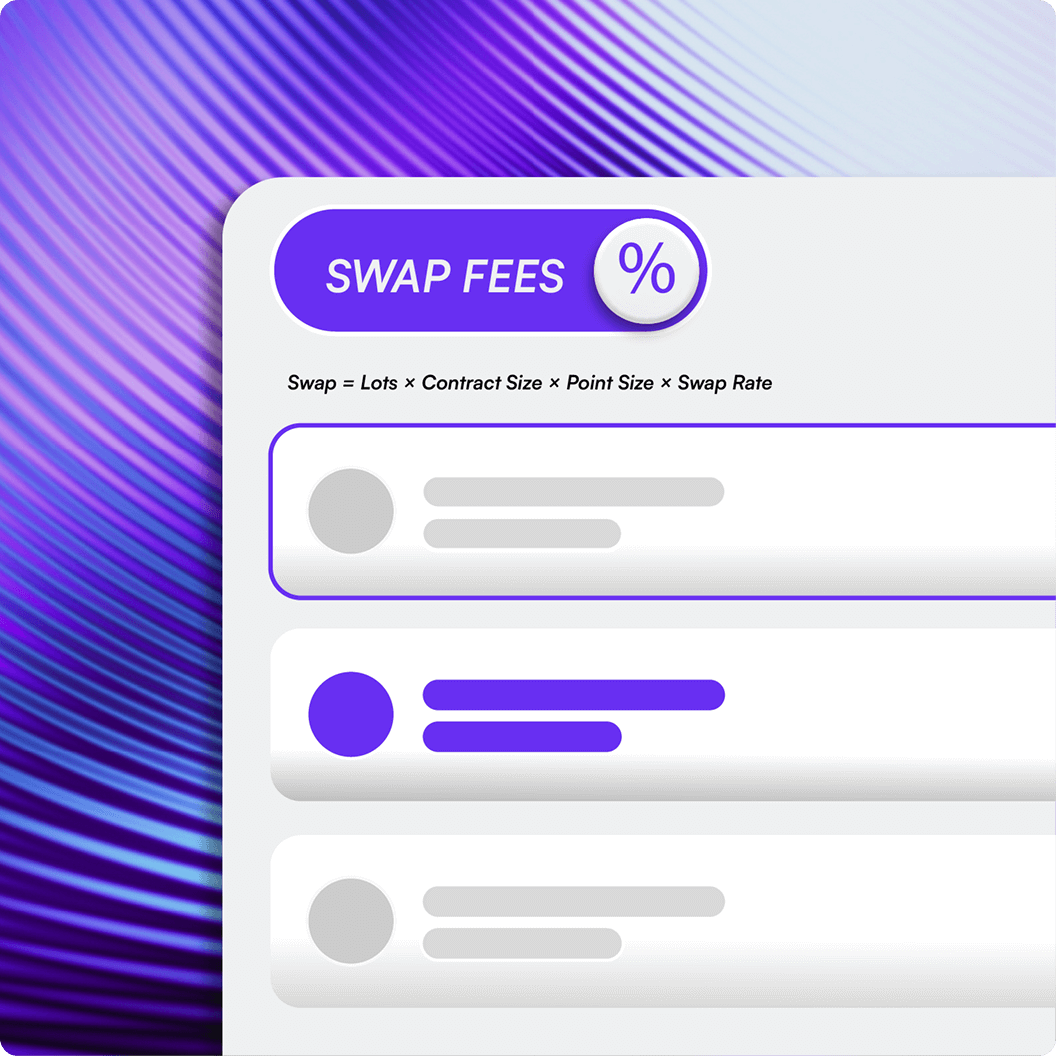

What Are Swap Fees?

Swap fees, also known as rollover fees, are charges applied when you hold a trading position overnight. These fees don’t apply to trades that are opened and closed on the same day. Depending on whether your position is long (buy) or short (sell), the swap can either be credited or debited to your account. All open positions are automatically rolled over to the next trading day, except from positions held overnight on Wednesdays for all CFDs, which incur a 3-day swap to cover the weekend. The swap fee is calculated using the formula:

Swap = Lots × Contract Size × Point Size × Swap Rate

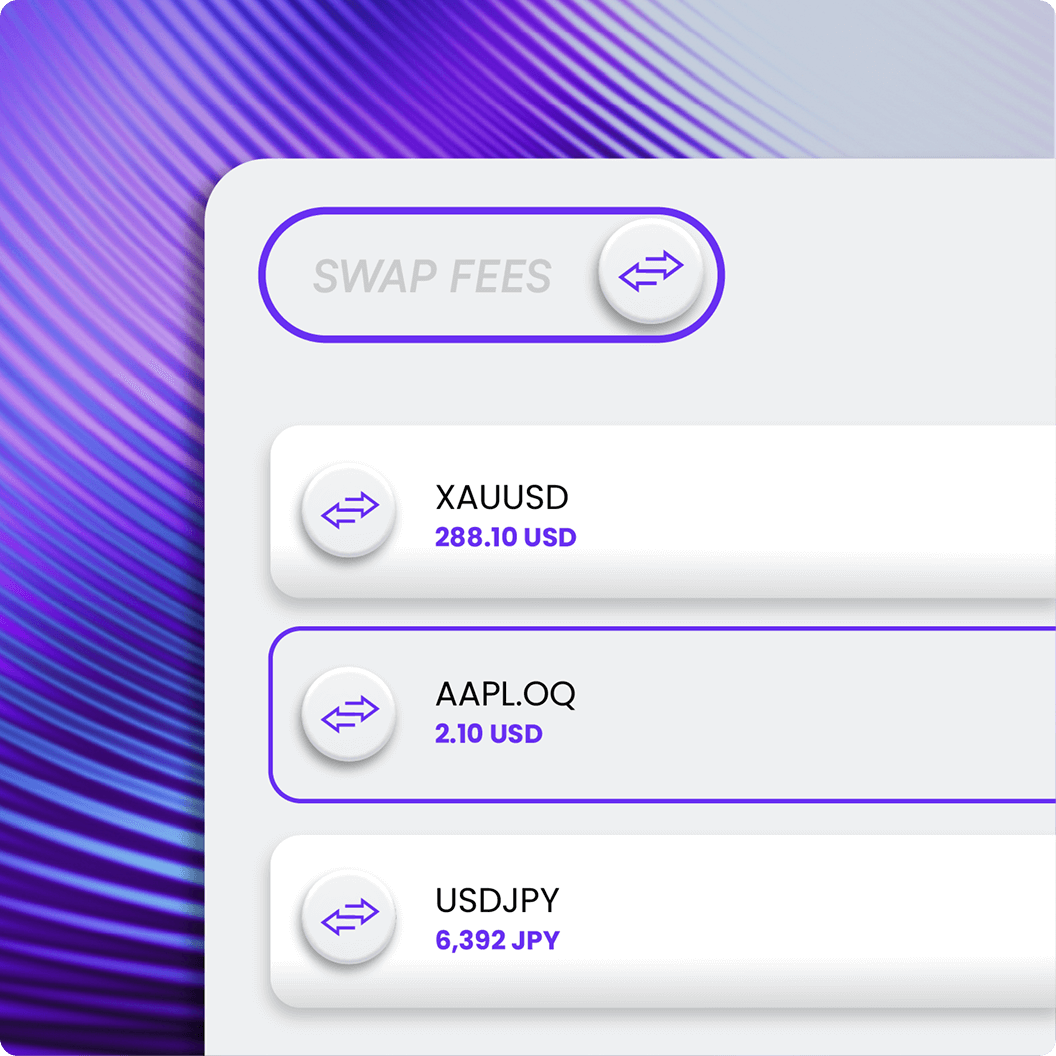

Swap Fee Examples

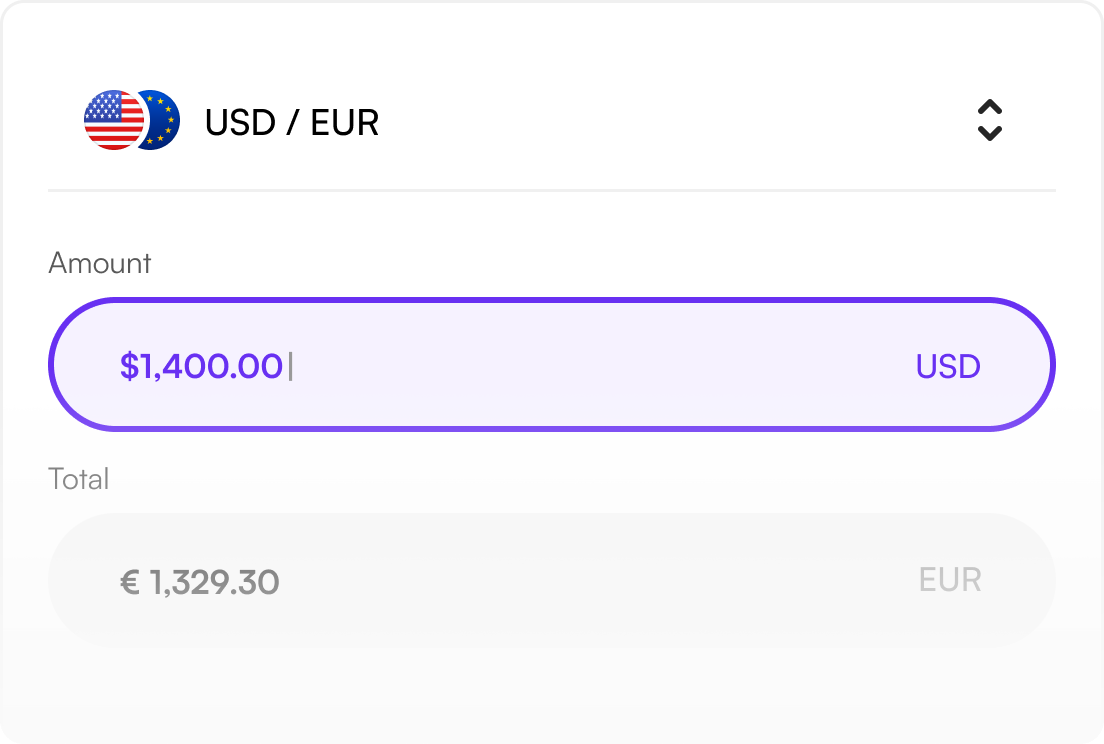

Below are some examples of how this formula can be used: XAUUSD - 2 Lots SELL Lots x Contract Size x Point Size x Swap Rate 2 x 100 x 0.01 x -144.05 = -288.10 USD AAPL.OQ - 5 lots BUY Lots x Contract Size x Point Size x Swap Rate 5 x 1 x 0.01 x -42 = -2.10 USD USDJPY - 1 Lot BUY Lots x Contract Size x Point Size x Swap Rate 1 x 100,000 x 0.001 x -63.92 = -6,392 JPY Keep in mind that bank holidays can affect the number of days a position is rolled forward, so it’s good to keep an eye on the trading calendar.

Discover the Savexa Experience

Explore the future of trading with Savexa. Our cutting-edge platform ensures a streamlined and powerful trading experience across various financial markets.

Simplified Trading Process

- Easy-to-Use, Intuitive Design

- Single-Click Trading Features

- Effortless Platform Navigation

- Personalized Trading Interface

Trusted & Secure Trading

- MWALI Licensed

- Client Funds Held Separately

- Advanced Transaction Encryption

- Trading Servers in SAS 70 Certified Facilities

Round-the-Clock Assistance

- 24/7 Multilingual Support

- Premium Customer Service

- Comprehensive Help Center

- Support Tailored to Your Needs

Eager to Learn More?

Get in TouchYour Trading Journey Begins Here

Important information:

Thank you for visiting Savexa

Please note that Savexa does not accept traders from your country